Black money is the money that has been managed to be kept out of the reach of tax authorities, purportedly to escape tax evasion. Black money should be accounted for and tax deducted to make the economy grow and prosper.

Short and Long Essay on Black money in English

Essay on Black money for students of class 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, and class 12 in English in 100, 150, 200, 250, 300, 500 words. Also find short Black money essay 10 lines.

Black money essay 10 Lines (100 – 150 Words)

1) Black Money is the hidden money that remains out of reach of tax authorities.

2) The money for which people don’t pay tax is considered black money.

3) Black money is not good for the country’s economic development.

4) India ranks among the highest countries with black money in the foreign account.

5) Bribe and corruption generate black money in the country.

6) Businessmen, politicians, wealthy people, etc are involved in the circulation of black money.

7) Black money gives benefits to the rich people while badly affecting the poor.

8) Government takes many steps to control black money as it is illegal.

9) Demonetization was a good step towards controlling black money.

10) Elections, tax laws, different excise rates, etc are the primary causes of black money.

Essay 1 (250 Words) – Black Money in India: Statistics and Causes

Introduction

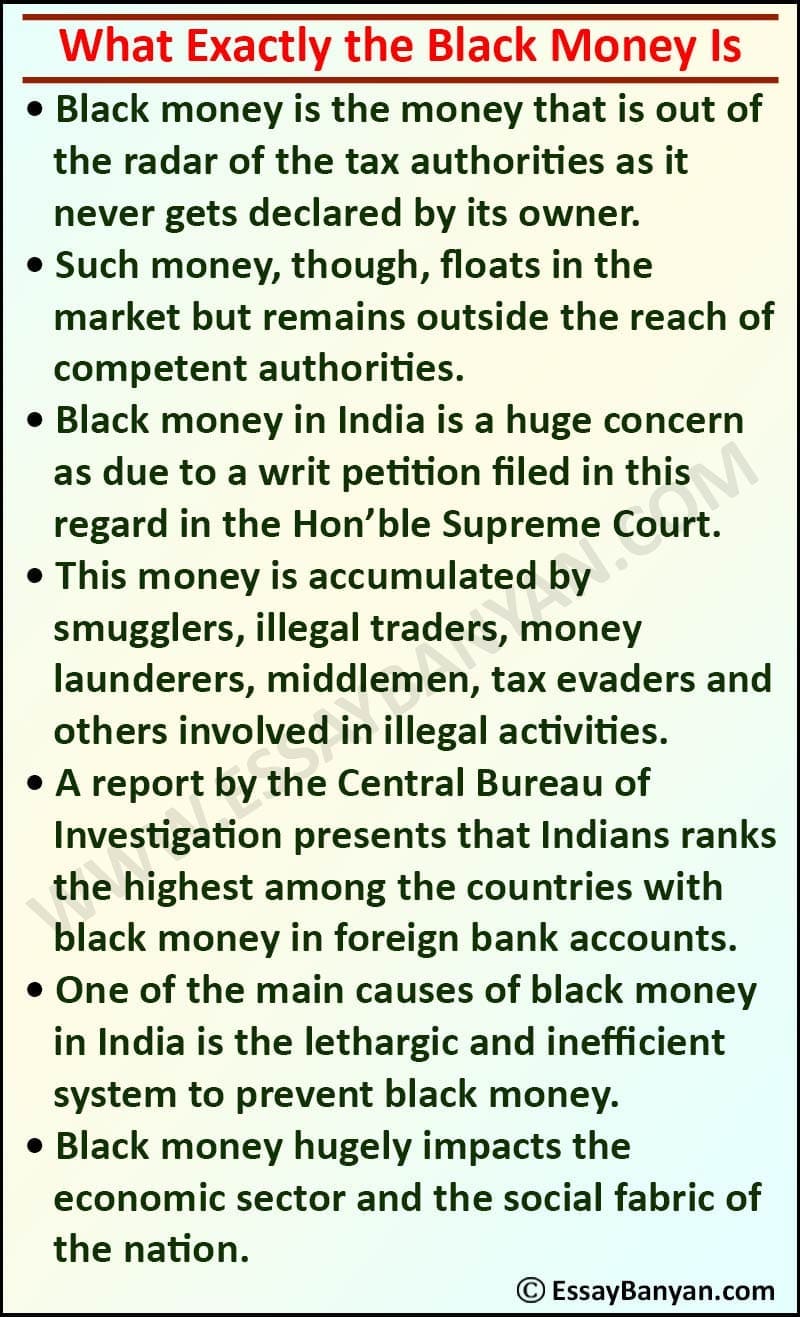

Black money is the money that is out of the radar of the tax authorities as it never gets declared by its owner. Such money, though, floats in the market but remains outside the reach of competent authorities.

Black Money in India – Statistics

Black money in India is a huge concern as due to a writ petition filed in this regard in the Hon’ble Supreme Court, it was estimated that the total amount of black money in India could be around Rs 300 lakh crores. This money is accumulated by smugglers, illegal traders, money launderers, middlemen, tax evaders and others involved in illegal activities.

There is also an estimated account of black money deposited by Indians in foreign bank accounts. Some estimates present that around $1.4 trillion are siphoned off by Indians in Switzerland.

A report by the Central Bureau of Investigation presents that Indians ranks the highest among the countries with black money in foreign bank accounts. The report also estimated the amount to be around $ 500 million.

Causes of Black Money

One of the main causes of black money in India is the lethargic and inefficient system to prevent black money. Offenders easily escape detection by paying a bribe to the tax authorities and other competent authorities. Large business houses, politicians, bureaucrats use their influential connections to escape the tax net and accumulate wealth, that hasn’t been accounted for. This forms a kind of safe haven for the black money to flourish and grow at an unprecedented rate.

Conclusion

Black money hugely impacts the economic sector and the social fabric of the nation. It drains the public resource system and makes basic amenities a rarity. It is imperative to take the necessary steps for eliminating black money and bringing it under taxation. This way the tax deducted could be used for public welfare schemes.

Essay 2 (400 Words) – Different Causes of Black Money

Introduction

The money that has successfully evaded taxation by relevant authorities is termed as black money. Black money is a setback to the economic growth of a nation and also causes general unrest among the people.

Causes of Black Money

There are many causes of black money generation. Sometimes the government itself could be held responsible while in other individuals and business houses are responsible. Below described are some of the main causes of black money –

- Ineffective Tax Laws

Sometimes the tax laws are too ineffective to check the loopholes, giving a good chance to tax evaders. They manipulate their tax declarations with the help of account professionals and clearly evade taxes. Even if a person is caught with black money, often the penalty implemented is too low to instill fear in the person.

- Evasion of Excise Duty

Several manufacturers of different goods take advantage of varied excise rates and often downgrade a particular product to escape taxation. This alone amounts to a black money generation to the tune of thousands of crores annually. This is a huge loss to the government’s exchequer.

- Forging the Invoices

Many firms involved in overseas trade business, manipulate their invoices to evade taxation and also to avail of various tax benefits. This is carried out in connivance with tax officials and causes huge losses to the government in form of taxes. This is a common practice carried out by traders and business houses.

- Corrupt Public Distribution System

A corrupt and faulty public distribution system results in a price rise of the commodities. Due to a drop in supply, the demand increases, thereby, causing the prices to shoot up. This, in turn, results in the accumulation of black money. With this corrupt system neither the public gets fair value for the goods nor does the government get the necessary taxes.

- Democratic Elections

Elections in a democracy are rum with money. Parties spend thousands of crores on electoral campaigns and other related expenses. Such a huge expenditure requirement encourages black money generation to various parties with a vested interest in political results. Big business houses resort to illegal methods of tax evasion to support the campaigns of political parties.

Conclusion

Black money is a drain in the economy of the nation and all methods to eliminate black money from the market must be carried out. As long as black money remains, there would be no true economic growth and social equality.

Essay 3 (500 – 600 Words) – Sources of Black Money and Its Effects on Economy

Introduction

Money that has not been accounted for, or which escapes taxation as it wasn’t declared is called ‘black money’. It also includes the income earned by illegal means and deliberately not declared to the government to escape taxation.

Black Money Sources

There are many sources of black money in a growing or developed economy. It comes primarily in the form of a bribe by corrupt government officials, politicians and also those in the private sectors.

In both the government and private sectors, the responsible accept cash as a bribe for making undue favors. This money is never declared to the tax authorities and therefore remains always unaccounted. The tax on that money could have very well been used for the government’s public welfare schemes.

Another source of black money is price manipulation; a common practice by parties involved in trade, mainly to avoid taxation. In this method, the trading firms declare the manipulated prices of the goods, while the actual prices could have been different. This way a lot of cash escapes taxation and the money is subsequently invested in bogus companies.

Effects of Black Money on the Economy

Black money disturbs the economy of a country as well as increase the social and economic divide. Every year the government loses crores of rupees as black money that escapes taxation. The tax collected by the government could have been used for the building of schools, hospitals and other infrastructural development or welfare schemes. But as the money escapes the taxation it is never accounted for and goes completely unnoticed. Therefore, black money slows down the economical growth of a country.

Another effect of black money is that it increases the social divide by making the rich richer and the poor poorer. The money that should be taxed and used for the welfare of the poor never reaches the government’s coffers. As a result, the rich get richer by evading tax and the poor remain in the sorry state of things.

It also affects the general perception of common people on their government and its functions. With the rampant black money trade, people tend to lose trust in their own government, often causing unrest.

Unaccounted black money in the market also causes the prices of goods and commodities to rise high, resulting in general unrest and a damaged economy.

Solutions for Black Money

The first and foremost solution to check black money is to bring it under the knowledge of tax authorities. This could be done by making necessary changes in existing tax laws and giving more powers to the tax authorities.

Voluntary disclosure schemes implemented from time to time by the government are another step towards countering black money. The government gives a chance to the black money holders to declare their amount within some stipulated period of time to escape legal penalization. To encourage people, for declaring black money the government lures them with a low tax rate and no questions asked kind of policy.

Another measure employed by the government to counter black money is demonetization. In demonetization the currency pertaining to a specific denomination/s is declared void beyond a specified time, thereby making the currency redundant. Anyone in possession of such currency either has to declare it to the bank and get it exchanged with legal tender or get it destroyed. Though demonetization might cause some inconvenience to the general population, it is actually beneficial to the economy by getting the black money declared.

Conclusion

Black money isn’t only a drain in the economy but also a hindrance to the development of society. The presence of black money leads to the polarization of society as the divide between the rich and poor increases.

FAQs: Frequently Asked Questions

Ans. The money that is earned by unethical ways is called black money.

Ans. The major source of generating black money in the olden days was gold trading.

Ans. The circulation of black money is called a parallel economy.

Ans. The transparency of transactions in cashless transactions will help to reduce the flow of black money.

Ans. This act was launched in India to stop the flow of black money and impose a tax on secret assets.