It is very difficult for people to carry cash in larger amounts. We have been noticing the news of robbery or thefts in the newspapers regarding these cases. The new emerging technology namely cashless India has made transactions easy for the people. We need not carry cash amounts but the same can be given by card payment or via online applications.

Every time while paying bills, sending or receiving money, payments on the shop we can use this technology. This reduces the time and effort of people in India. There are many more things that you need to know about the topic. It has been given in form of a long essay that may be an aid to school, college, and university students.

Short and Long Essay on Cashless India in English

Short and long essays on Cashless India in different word limits are given below for students of classes 1, 2, 3, 4, 5, and 6. The language is kept simple so that every student can understand these essays properly.

10 Lines Essay on Cashless India (100 – 120 Words)

1) The government launched the “Cashless India” scheme to make India a cashless economy.

2) A cashless economy promotes online transactions instead of cash transactions.

3) As part of Digital India launched on 1 July 2015, a cashless India is envisioned.

4) This scheme will also help in controlling corruption.

5) The growing cases of robbery and theft will also be reduced due to this scheme.

6) Cashless transactions are fast and more secure than cash transactions.

7) This scheme aims to carry out all the financial activities digitally without involving physical cash.

8) Cashless transactions can be done through UPI (Unified Payment Interface), online banking, micro ATMs, etc.

9) However, online transactions are prone to cybercrimes.

10) This scheme is a disadvantage for poor and illiterate people.

Essay 1 (250 words) – Advantages and Disadvantages of Cashless India

A cashless economy means curbing cash transactions and carrying out online transactions. The scheme cashless India had been launched by the government of India to make India a cashless economy in the world. Here we will be discussing the advantages and disadvantages of going cashless.

Advantages:

- Fast and convenient transactions – The transactions can be easily done by using smartphones through Paytm, Google pay, UPI, etc. The process is very fast and easy to do.

- No theft risks – When we opt for cashless transactions we will not have to carry cash with us. This will reduce the chances of theft.

- Environment-friendly – Cashless transactions will help in reducing the charges of printing currency notes and coins. It promotes the efficient use of paper and hence an eco-friendly initiative.

- Exciting discounts – We avail of good cashback and offers whenever we do debit/credit card or online transactions.

- Reduce corruption – In cashless transactions; there will be transparency as the transactions can easily be traced. Therefore it will help in reducing the bribery and flow of black money in India.

Disadvantages:

- Risk of online crimes – The risk of online fraud and cheating is a threat in doing online transactions. People fear doing online transactions as many have been the victim of these online frauds. The government needs to impose a high-security check in the system to foster safe digital transactions otherwise the dream of making India a cashless nation can never come into reality.

- Poverty and illiteracy – Many people in India are illiterate and are living in poverty. People in rural areas do not know how to use smartphones. It is difficult to make this mission successful without eliminating these problems.

Essay 2 (600 Words) – Meaning of Cashless India and Digital Payment Methods

Introduction

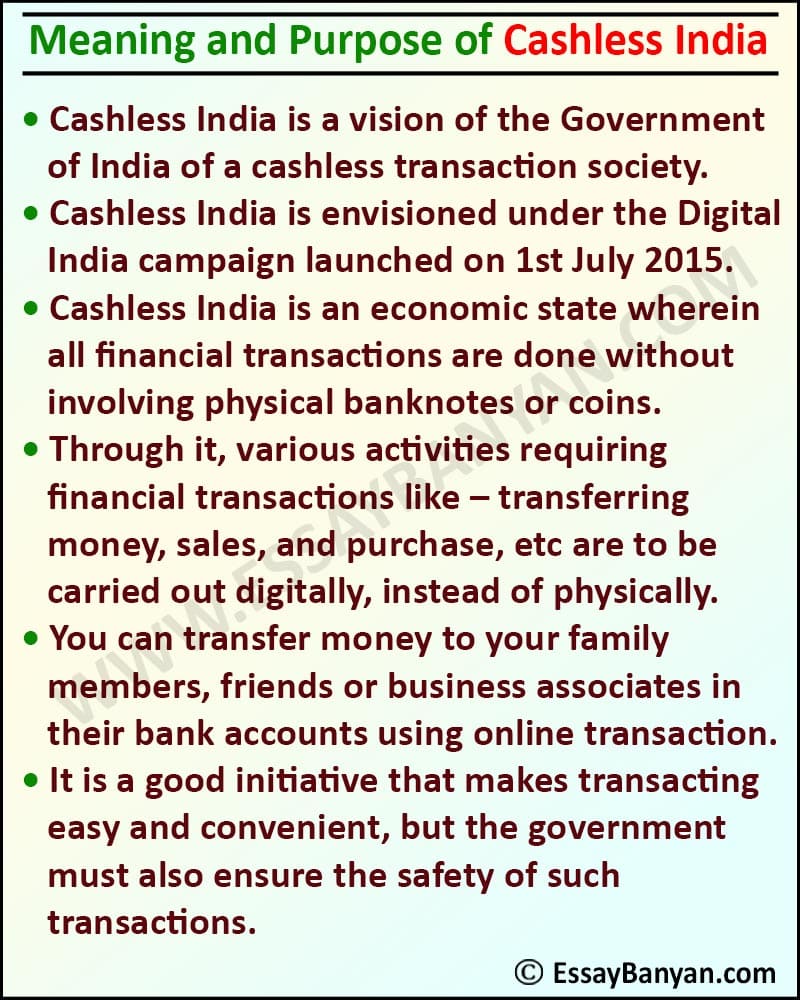

Cashless India is a vision of the Government of India of a cashless transaction society. Cashless India is envisioned under the Digital India campaign launched on 1st July 2015.

Meaning of Cashless India

Cashless India would be an economic state wherein all financial transactions are done without involving physical banknotes or coins. That is, various activities requiring financial transactions like – transferring money, sales, and purchase, etc are to be carried out digitally, instead of physically.

For example, if you are out for making a purchase of groceries for home, you should be able to do it without a single penny in your pocket. This kind of transaction mandates two essential requirements – firstly you must have a debit card, credit card, or any web application that certifies your bank account and authenticates transactions on your behalf. Secondly, the seller, in this case, the grocery shop owner must be in the possession of a Point of Sale (POS) device to carry out the transaction. At the end of the transaction, your bank account will be debited and the account of the shopkeeper will be credited without an exchange of any physical currency.

Likewise, there could be several examples of cashless India, like transferring money to your family members, friends, or business associates, without even physically depositing the money in their bank accounts.

Digital Payment Methods

The following digital payment methods are used under the Cashless India campaign –

- Banking Cards

Different kinds of banking cards are debit cards, credit cards, travel cards, cash cards, etc. The cards offer discounts and additional facilities, for digital transactions. Also, the transaction is secured by two-way authentications, involving secure PIN and OTP (One Time Password).

- Unstructured Supplementary Service Data (USSD)

This service allows financial transactions to be carried out without an internet connection and through the basic phone. ‘*99#’ could be dialed from the phone to avail services like interbank fund transfer, mini statement, balance inquiry, etc. This service empowers the rural population or the elders, who usually use basic keypad phones and are not comfortable using smartphones.

- Unified Payment Interface (UPI)

Unified Payment Interface is an application that allows managing multiple bank accounts through a single platform. You only have to download the UPI App on your smartphone and provide the account and bank details you want to link. The services offered are many, including a balance inquiry, money transfer, transaction history, etc.

- Mobile Wallet

Mobile Wallet allows you to carry money digitally on your mobile. The mobile wallet application could be linked to credit or debit cards and can be used for online transfer of money. The mobile wallet allows you to carry out financial transactions without requiring physical debit or credit card.

- Point of Sale (POS) Device

A point of sale device is a small cordless device available at merchant establishments to carry out financial transactions. Customers are required to swipe their credit/debit cards and authenticate the transaction by entering a PIN in the device, which then completes the transaction and prints a receipt.

- Micro ATMs

Micro ATM is a small device given to business correspondents or small shop owners to carry out instant transactions on behalf of their customers. The device is connected to several banks across the country and allows instant deposits and withdrawal of money. The business correspondents act as a bank in this case.

Conclusion

Cashless India is the government’s initiative for a cashless society wherein financial transactions, howsoever, small or large are carried out digitally. It is a good initiative that makes transacting easy and convenient, but the government must also ensure the safety of such transactions.

FAQs: Frequently Asked Questions on Cashless India

Ans. Sweden has reduced its cash transaction to 2% and thereby moving towards a cashless nation in the world.

Ans. India invests 1.7% of its GDP in printing the cash.

Ans. It will be helpful in reducing crime and fraud and save money wasted on printing and circulating cash.

Ans. Yes, demonetization fostered online transactions as there was a scarcity of cash thereby giving a pace to cashless India.

Ans. Dhasai, a village in Thane district Murbad taluka in Maharashtra, is known to be the first cashless village in India.